Speakers

Emily Barker

Transaction Lead – Middle Market, Macquarie Group

Michael Batko

James Cameron

Jared Connor

James De Flumeri

Theodore (Ted) Dow

Alex Downie

Hugh Dyus

Lisa Fedorenko

Damian Fox

Kylie Frazer

Andrea Gallenca

Adrian Herbert

Simon Horne

CEO, Angel Loop

Christian Jensen

Christopher Koeck

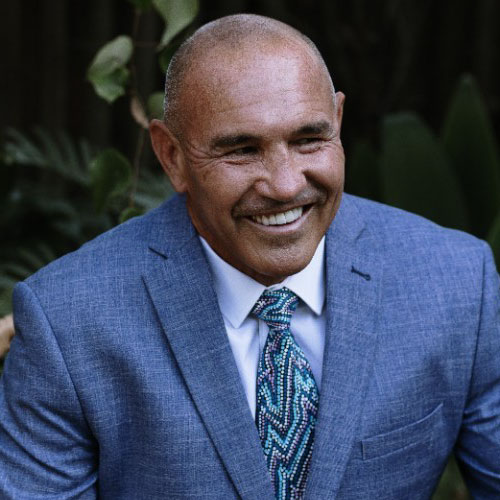

Martin Lakos

Martin Lakos has been one of Macquarie’s leading media spokespeople for over 15 years and a public speaker for over 8 years. He is a regular economic and market commentator on the major Australian TV networks as well as CNBC and Bloomberg.

Known for his ability to clearly explain complex economic issues and market trends, Martin is passionate about a broad spectrum of issues and can confidently address an extensive range of topics – from big picture macroeconomics and current trends, to interest rates, investor strategy and what’s happening in key global markets.

He frequently gives presentations or facilitates panel discussions at conferences around Australia, providing a personalised approach to the key issues facing a specific industry group or business.

Having literally grown up in the finance industry where he worked for school holiday pocket money, Martin has always been fascinated by the economy and investment markets. His financial career spans 43 years, having started on the Australian Stock Exchange trading floor in 1979 and he has held roles in Macquarie since 1994, including heading up the Asia institutional sales desk. He was appointed a Division Director of Macquarie Bank in 2006.

When he is not addressing conferences or the media, Martin is a senior investment adviser with Macquarie Private Bank, advising clients and their families on a full range of wealth strategies.

He also devotes his spare time to not-for-profit groups and is a board member of Epilepsy Action Australia, is on the Australian Stockbrokers Foundation organising committee and was on the The George Gregan Foundation for 15 years until it recently concluded its activities. He spent nine years on the Juvenile Diabetes Foundation corporate fundraising committee with three years as chairman and has emceed at the Gala Ball event.

Jeremy Larkin

David Liddiard

Co-Founder and Director, Biripi Capital

Devon Long

Michael Manikas

Co-Founder and Director, Biripi Capital

Sarah Nolet

Simon Pither

David Potter

Pete Seligman

Darren Smorgon

Anthony Ward

Heidi Wilson

Transaction Lead, Macquarie Group

Olympia Yarger

Growth Capital Forum 2023 • Privacy Policy • Community Charter